Our weekly newsletter covers news, industry perspectives, and updates from the USBC ecosystem. Check out our last report here.

This week:

The fundamental problem with stablecoins

USBC completes name and ticker change

Circle and Stripe are building blockchains

This week in digital dollars

Stuff happens

1. The fundamental problem with stablecoins

Money is often misunderstood. If you ask someone on the street where it comes from, they might tell you that the central bank prints it into existence.

The reality? Most money creation comes from banks. When you deposit your money into a bank, it then goes and lends the bulk of those deposits out to individuals and businesses. This is how capital is distributed to where it can be more productive and it’s how the money supply (and in turn, the economy) expands. This process, known as fractional reserve, is a fundamental building block to how our modern economy works.

The problem? Stablecoins break this core economic puzzle piece.

Here’s the NYTimes (via Thomas Milkey):

Stablecoins eschew the century-old practice of automatic federal deposit insurance. If they fail, there is no guarantee of a government backstop.

Bankers say stablecoins, if widely adopted, could bring a radical change to the nuts and bolts of their industry, and they have the potential to upend a century of accepted banking practices.

One reason is that the money that a customer places with a bank in exchange for a stablecoin cannot be lent out in the same way that money placed in a traditional checking and savings account can be.

Any dollar that goes into a stablecoin and not a consumer’s traditional bank account essentially shrinks the size of a bank’s lending book and the bank’s deposit base overall. This means banks could have fewer deposits to make home or business loans with, which the Federal Reserve Bank of Kansas City last week warned could carry unintended consequences for the economy.

“The genie is out of the bottle,” said Mike Cagney, a former chief executive of SoFi and now the head of the digital lender Figure. He predicted that the rise of stablecoins would come at the expense of bank deposits. “You don’t need a lot of deposit flight to really buckle the banks,” Mr. Cagney said.

So if you’re a bank, why would you want stablecoins? Banks have deposits—they should leverage them. Tokenization would enable the benefits of blockchain in terms of speed, cost, and access to DeFi while maintaining all of the safeguards of traditional banking and preserving the ability to create credit in the wider economy.

Plus, tokenized deposits would be FDIC insured and pay interest—and when it comes to the latter, that’s apparently what consumers want (see #4 below).

2. USBC completes name and ticker change

USBC, Inc. (NYSE American: USBC) (“USBC” or the “Company”) announced today that it has changed its name from Know Labs, Inc. to USBC, Inc. The Company’s common stock will now trade on the NYSE American under the new ticker symbol “USBC,” effective at market open, August 15, 2025.

As previously announced, USBC’s name and ticker change follows the successful closing of the $125M strategic acquisition of a controlling interest in the Company on August 6, 2025 by Goldeneye 1995 LLC, an affiliate of the Company’s newly appointed Chairman and CEO, Greg Kidd.

“Changing our name and ticker symbol to USBC aligns with our new vision centered on the USBC deposit token,” said Mr. Kidd.

A quick disclaimer: The USBC ecosystem and the USBC Token are the product of substantial efforts by Greg Kidd and key members of the USBC ecosystem. Mr. Kidd is Chairman, CEO, and beneficially owns a controlling interest in the legal entity USBC, Inc. (NYSE American: USBC). USBC, Inc. does not own, control, or have any direct financial interest in the USBC ecosystem and the USBC Token discussed herein. USBC, Inc. does not receive any compensation, revenue share, royalties, or other economic benefit from the sale, distribution, or use of the USBC Token and USBC ecosystem as contemplated herein.

3. Circle and Stripe are building blockchains

Circle is building a privacy-focused blockchain that’s compatible with Ethereum. Here’s Coindesk (via Greg Kidd):

The company also said it is developing a layer-1 blockchain “designed to provide an enterprise-grade foundation for stablecoin payments, FX, and capital markets applications.” A public testnet for the Arc blockchain is scheduled to live in the next few months.

Arc is Ethereum Virtual Machine (EVM)-compatible and uses USDC as its native gas token, has an integrated stablecoin FX engine, and sub-second settlement finality along with “opt-in privacy controls,” the company said.

Not to be left out, Stripe (inadvertently) revealed their own blockchain plans (through a job listing). Here’s Fortune:

The fintech giant Stripe is developing a new blockchain, according to a recent job posting on a site for the crypto lobby group Blockchain Association. “Tempo is a high-performance, payments-focused blockchain,” reads the job advertisement, which is for a product marketing position and dated Aug. 3.

The posting goes on to say that Tempo is in stealth, has a team of five, and is being built in partnership with Paradigm—a crypto venture capital firm whose cofounder and managing partner, Matt Huang, is on the board of Stripe. Applicants for the marketing position should have “experience marketing to a Fortune 500 audience,” per the ad.

The blockchain is a layer 1, or not built on top of other protocols, and it’s compatible with the coding language used on the blockchain Ethereum, according to four sources briefed on the matter. All sources requested anonymity to talk about private business conversations.

Spokespeople for Stripe and Paradigm declined to comment. The job posting was taken down after Fortune reached out to both companies.

Relevant:

Stripe’s Mysterious New Blockchain Could Rival Ethereum - Crypto Economy

VC firm Paradigm co-founder Matt Huang to lead Stripe’s blockchain project Tempo: Fortune

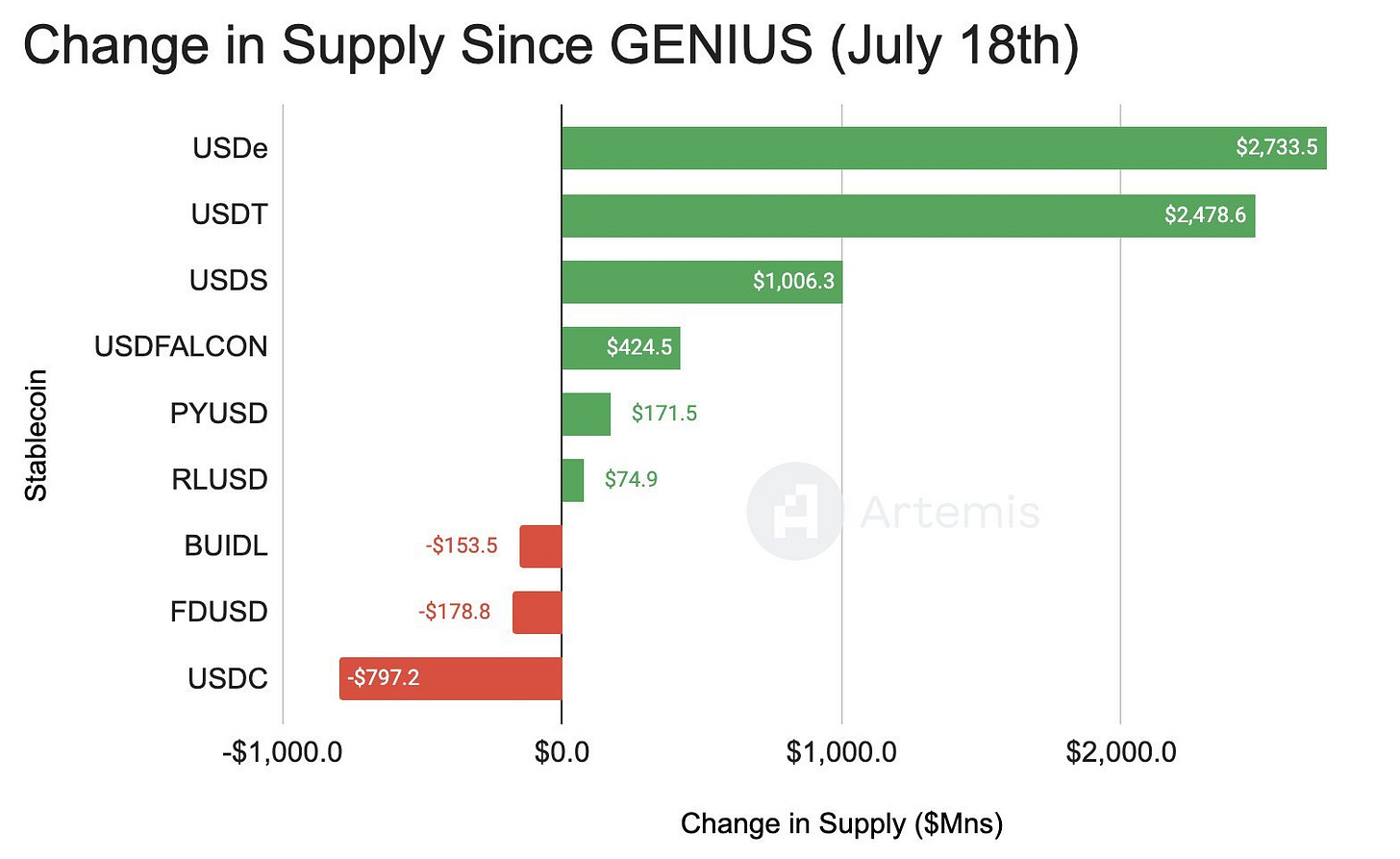

4. This week in digital dollars

The Bank Policy Institute wants to make sure stablecoins aren’t paying interest (through GENIUS Act loopholes):

But apparently and perhaps unsurprisingly, that’s what consumers want from their digital dollar products (via Tim Lewkow):

Elsewhere:

Companies plan stablecoins under new law, but experts say hurdles remain

Visa’s Crypto Chief Aims to Leverage $2 Trillion Stablecoin Era